Note: Medicare Supplement Plan F is no longer available for people who turned 65 after January 1, 2020. If you were interested in signing up for it, you might consider checking out our Medigap Plan G vs Medigap Plan N article instead. Those two plans are considered common alternatives to Medigap Plan F.

If you’re here to learn more about Medigap Plan F—either because you’re enrolled in it or just for research purposes—then read on!

In this article, we’ll give you a complete overview of the plan, including what it covers and doesn’t cover, how much it costs, and why it’s no longer available to people aging into Medicare.

Key Takeaways

- Medicare Plan F is a Medicare Supplement Plan that covers the gaps of Original Medicare, including your Part B deductible.

- People who turned 65 on or after January 1, 2020 (or whose Medicare Part A coverage begins on or after January 1, 2020) are no longer eligible to enroll in this plan. However, people who are already enrolled in Medigap Plan F are allowed to keep it.

- The premiums for Medigap Plan F are expected to rise in the coming years because people aging into Medicare are no longer eligible to enroll in the plan. This is why many licensed insurance brokers recommend looking at your budget and switching if it doesn’t make financial sense for you anymore.

- Medicare Supplement Plan G and Medigap Plan N are seen as common alternatives to Medigap Plan F, but you may also want to consider looking into Medicare Advantage Plans.

How Does Medicare Supplement Plan F Work?

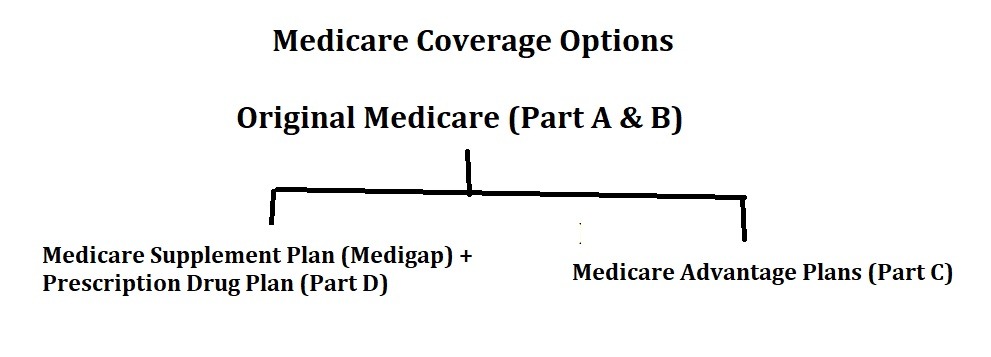

Medigap Plan F is a Medicare Supplement Plan provided by insurance companies to help cover the “gaps” in Original Medicare. Medigap Plan F was one of the most popular Medicare Supplement plans before it was closed to people aging into Medicare on January 1, 2020.

Original Medicare only covers roughly 80% of your healthcare costs. You’re responsible for paying the remaining 20% out-of-pocket in the form of deductibles, copays, and coinsurance.

This is why most people get additional coverage in the form of either:

- a Medicare Advantage Plan

- or a Medicare Supplement Plan, plus a Part D prescription drug plan.

Before becoming unavailable to people turning 65 in 2020, Medigap Plan F was the most popular Medicare Supplement Plan with over 6.8 million enrollees (AHIP).

Of all Medicare Supplement Plans still around today, Medigap Plan F is the only one with no cost-sharing. With Medigap Plan F, all you have to pay is the Medicare Part B and Plan F premiums.

What Does Medigap Plan F Cover?

Medigap Plan F covers all the gaps in Original Medicare. This includes:

- Medicare Part A Deductible – Medicare Part A is the branch of Medicare that covers your inpatient hospital costs. The Medicare Part A deductible is the amount you have to pay out-of-pocket first before Medicare starts covering your bill. With Medigap Plan F, your insurance company will be the one to pay for the deductible for you. The Medicare Part A deductible for 2024 is set at $1,736 per benefit period.

- Medicare Part A Copays – If you’re admitted to a hospital for more than 60 days, you’ll have to start paying copays. This is a fixed amount you have to pay out-of-pocket per day, while Medicare will cover your remaining bill. However, people with Medigap Plan F don’t have to worry about making these copays out-of-pocket.

- Skilled Nursing Facility Copays – Like hospitals, if you’re admitted to a skilled nursing facility, Medicare Part A will also help cover your costs. However, after 20 days at the facility, you’ll also be responsible for copays, which Medigap Plan F will cover for you.

- Medicare Part B Deductible – Medicare Part B is the branch of Medicare that covers your medical costs. Like Medicare Part A, the Medicare Part B deductible is the amount you have to pay out-of-pocket before your coverage starts. Medigap Plan F will cover the Medicare Part B deductible for you.

- Medicare Part B Coinsurance – Once you meet your Medicare Part B deductible, most services and items covered under Medicare Part B come with a 20% coinsurance. This means that Medicare will pay 80% of the cost while you pay the remaining 20% out-of-pocket. But with a Medigap Plan F, your insurance company will pay the 20% you’re responsible for.

- Medicare Part B Excess Charges – Most healthcare providers that accept Medicare also accept the Medicare-approved amount for items and services. But providers that don’t accept this may charge up to 15% more, and you are responsible for paying for this excess out-of-pocket. However, if you’re enrolled in Medigap Plan F, your insurance company will cover this excess amount.

Aside from these, Medigap Plan F also covers foreign travel emergencies (up to 80% of the cost) and the first three pints of blood (if you buy them from a blood bank).

With Medigap Plan F, you won’t have to worry about copays for most Medicare-covered items or services.

To help you understand why this plan was so popular, here’s a quick look at how Medigap Plan F compares to Medigap Plan G and Medigap Plan N (two of the most popular Medigap plans today).

| Medigap Plan F | Medigap Plan G | Medigap Plan N | |

| Medicare Part A coinsurance and hospital costs (up to 365 days after Medicare benefits are used up) | ✅ | ✅ | ✅ |

| Medicare Part B coinsurance and copayments | ✅ | ✅ | ✅❌(Office and ER visits excluded) |

| Blood transfusion (first three pints) | ✅ | ✅ | ✅ |

| Medicare Part A hospice care coinsurance and copayments | ✅ | ✅ | ✅ |

| Skilled nursing facility care coinsurance | ✅ | ✅ | ✅ |

| Medicare Part A deductible | ✅ | ✅ | ✅ |

| Medicare Part B deductible | ✅ | ❌ | ❌ |

| Medicare Part B excess charge | ✅ | ✅ | ❌ |

| Foreign travel emergencies | 80% | 80% | 80% |

| Out-of-pocket limit | ❌ | ❌ | ❌ |

What Does Medigap Plan F Not Cover?

Like all Medicare Supplement Plans, Medigap Plan F typically does not cover your Medicare Part B premium. It also doesn’t usually include a prescription drug plan, nor does it have benefits for dental, vision, and hearing care.

Remember, Medicare Supplement Plans (Medigap) help cover the “gaps” in Medicare’s coverage. This does not include the Medicare Part B premium you pay to Medicare.

[Unlike Medicare Advantage Plans, Medigap Plan F doesn’t include prescription drug coverage. This is why people who choose to get a Medicare Supplement Plan should also look into getting a standalone Medicare Part D prescription drug plan (if they don’t have creditable coverage elsewhere).

Finally, Original Medicare and all Medicare Supplement Plans don’t include coverage for dental, vision, and hearing care. To get coverage for these, you can either enroll in a Medicare Advantage Plan that includes dental-vision-hearing benefits or enroll in standalone insurance plans.

How Much Does Medigap Plan F Cost?

According to Forbes Health, the average cost of a Medigap Plan F is roughly $230/month. However, the actual price of Medigap Plan F depends on the plans available in your area.

If you hop on Medicare’s plan finder, you’ll find that the prices are drastically different depending on your zip code.

To find the price range of Medigap Plan F in your area, you may contact a licensed insurance agent to provide you with quotes from several different insurance companies. Call or text us at +1 877-360-6565 (TTY: 771) and we’d be glad to assist you!

In some areas, Medigap Plan F costs as low as $150/month, while in other parts of the country, it can cost over $400/month.

Here are some examples:

| Zip Code | Price Range* |

| 90001 (Los Angeles) | $178 – $346 |

| 77001 (Houston) | $161 – $620 |

| 10001 (New York City) | $359 – $843 |

*prices taken from Medicare.gov for males aged 65 who don’t use tobacco and have no applicable discounts

Also, as a rule of thumb, you shouldn’t only consider the price of the plan but also the reputation of the insurance company.

Medicare Supplement Plans usually raise their prices every year (and as you get older). You’ll want to look for a plan with stable rates and smaller yearly increases, rather than a company with erratic price changes.

Note: Don’t want to search for a good Medicare Supplement Plan on your own? You can get a licensed insurance agent to help at no cost to you. Call or text us at +1 877-360-6565 (TTY:711), or use the chat widget at the bottom right of your screen!

Is Medigap Plan F Becoming More Expensive?

Because people aging into Medicare are no longer eligible to enroll in Medigap Plan F, the premium for people already on the plan is expected to rise sharply in the coming years.

Medigap Plan F may be suffering from a phenomenon known as an insurance death spiral.

Most insurance plans depend on healthy payors to offset the costs of claims for the sick people on the plan. This is why plans with a large pool of enrollees typically have more stable rates.

However, if a plan no longer accepts new enrollees, most people on the plan will eventually get sick and start turning in claims.

When the price of the claims far outweighs the income from premiums, many insurance companies raise the premium for people already on the plan to keep up with the costs.

This is why most licensed insurance brokers today expect Medigap Plan F prices to rise quickly in the coming year.

Alternatives to Medicare Supplement Plan F

If you’re disappointed you can’t get Medigap Plan F anymore, or you’re on the plan and want to get out, then here’s a quick rundown of some of the alternatives to this plan:

- Medicare Supplement Plan G – Many people see Medigap Plan G as the “successor” of Medigap Plan F. The only difference in coverage between these plans is typically that Medigap Plan G doesn’t cover the Medicare Part B deductible. That’s why when Medigap Plan F was discontinued for people aging into Medicare, Medigap Plan G saw a big increase in enrollment numbers.

- Medicare Supplement Plan N – Medigap Plan N is often seen as a less expensive alternative to Medigap Plan F and G. It only covers four of the six gaps of Original Medicare (it doesn’t cover the Medicare Part B deductible and excess charge, and has small copays for office and ER visits), but is often priced slightly lower than Medigap plans F and G.

- Medicare Advantage Plans – Another option is to go the other route and choose a Medicare Advantage Plan instead. Medicare Advantage Plans typically have notably lower premiums than Medicare Supplement Plans, and many also have drug plans built into them, as well as coverage for dental, vision, and hearing care.

Can You Switch Out of Medicare Supplement Plan F?

Yes, you can switch out of Medicare Supplement Plan F. However, if you want to switch to another Medicare Supplement Plan, you may have to undergo a medical underwriting process.

You can usually switch Medicare Supplement Plans any time of the year.

If you do this during the Medigap Initial Enrollment Period (typically 6 months starting when you’re 65 or older), you can usually switch Medigap policies without undergoing medicare underwriting.

However, if you do this outside the Medigap Initial Enrollment Period, you may have to answer medical questions. If you have a significant pre-existing health condition, you will likely not be approved for the policy.

There are also a few Guaranteed Issue Rights situations that allow you to enroll in a Medicare Supplement Plan without undergoing underwriting, even if you have a pre-existing health condition. However, you have to qualify for them.

If you want to switch to a Medicare Advantage Plan, the timing is slightly different.

According to Medicare.gov, you can generally only join a Medicare Advantage Plan during the Annual Enrollment Period, which runs from October 15 to December 7 every year — or the Open Enrollment Period (January 1 to March 31 every year).

Unlike Medicare Supplement Plans, most Medicare Advantage Plans don’t require medical underwriting—so you can usually enroll even if you have a pre-existing condition.

However, remember that it can be difficult to switch back to a Medicare Supplement plan later if you get really sick, because significant pre-existing conditions typically make it more difficult to get approved for a Medicare Supplement plan.

Who Was Medicare Supplement Plan F Preferred By?

Medigap Plan F was often preferred by people who wanted as much coverage as possible. Medigap Plan F was also popular with people who were okay with paying more on premiums to avoid unexpected expenses.

Medigap Plan F was usually priced higher than other Medicare Supplement Plans. However, since all gaps in Original Medicare were covered, people could easily compute their Medicare costs for the year.

Medigap Plan F was also a common choice since the Medicare Part B deductible was covered. This meant that people on the plan could go to a doctor’s office almost anytime and not worry about out-of-pocket spending.

Why Was Medigap Plan F Discontinued for People Aging Into Medicare?

In 2015, Congress passed the H.R.2 bill, which discontinued Medicare Supplement Plans that cover the Medicare Part B deductible, effective January 1, 2020.

Congress passed this bill to prevent abuses. Since Medigap Plan F covered the Medicare Part B deductible, people could get Medicare-covered items and services even if they didn’t need them (there was no out-of-pocket cost to them).

In addition to Medigap Plan F, Medigap Plan C was also discontinued by this bill.

Need Help Finding the Right Plan For You?

Medigap Plan F was definitely common during its time, and for good reason!

No other Medicare Supplement plan covered all six gaps of Original Medicare in its time.

But with the plan no longer available to people aging into Medicare, there’s little use wishing it’ll return.

Instead, the best thing you can do is to study your other options with Medicare and find the plan that’ll work best for you.

If you want help at no cost to you, call or text our team of licensed insurance agents at +1 877-360-6565 (TTY:711) or use the chat widget at the bottom right of your screen.

Alternatively, you can check out our workshop that’ll teach you what you need to know about Medicare to make an informed decision. You can get free access to this workshop below: