Medicare can be so confusing.

There is Medicare Part A, Part B, Part C, and Part D, and there are mountains of information to learn about each part.

One part of Medicare that you’ll need to get very familiar with is Medicare Part A. However, the nuances of Medicare Part A can become very complex, especially for new people.

That’s why we’re here to simplify and explain how Medicare works in simple terms, so you can make an informed decision about when and how to sign up for Medicare — and which plan might be right for you.

Let’s tackle Medicare part A right now.

Key Points:

- Medicare Part A is essentially hospital insurance, usually covering hospital admissions, inpatient care at a skilled nursing facility, hospice care, and home health perks.

- Medicare Part A is funded primarily by payroll taxes, so if you worked for longer than ten years and paid Medicare taxes during that time, it should typically be at no cost to you.

- Medicare Part A is part of Original Medicare, along with Medicare Part B, which normally covers medical expenses—like doctor visits.

- The deductible for Medicare Part A isn’t annually, but rather for each benefit period.

What is Medicare Part A?

Medicare Part A can be defined as “hospital insurance.” Medicare Part A and Medicare Part B (Medical coverage) together are what we call Original Medicare. Original Medicare is provided directly by the federal government, while most other Medicare-related plans are typically provided by insurance companies.

What Does Medicare Part A Cover?

Medicare Part A is the part of Medicare that covers hospital costs. As part of Original Medicare, Medicare Part A is designed for those over the age of 65, people with disabilities, and people with end-stage renal disease.

If you need to stay at a regular hospital, nursing home, or skilled nursing institution, Medicare Part A would typically cover you. Medicare Part A usually also comes with some home health perks, that could include short-term, part-time caregiving by a skilled nurse, occupational therapist, physical therapist, or speech pathologist.

Hospital Admission

If you’re admitted to a hospital for inpatient care by a doctor, you normally have to pay the deductible of $1,736. After that, your hospital bills will typically be covered by Medicare Part A for a period of up to 60 days. After 60 days, you’ll be subject to copays.

It’s important to make sure the hospital accepts Medicare before you’re admitted, as some institutions don’t. While you’re hospitalized, a lot of your costs will be covered by Medicare Part A, including a semi-private room, hospital meals, medications, general nursing, and other services.

Qualifying hospitals typically include critical access hospitals, acute care facilities,

rehabilitation institutions, and psychiatric institutions. While Medicare Part A usually covers inpatient care at these hospitals, you will have to pay a deductible before coverage kicks in, as well as copays (depending on how long you stay).

Home Health

If you’re homebound and need help, Medicare Part A will normally cover a short-term, part-time skilled nurse, occupational therapist, speech pathologist, or physical therapist.

You will also usually be covered to a certain degree if you need medical social services or home health aid services.

You seldom have to pay for the above services, but you will need to pay towards the cost of any devices used during your care. It’s important to note that for Medicare Part A to cover home health services, the services need to be signed off by a doctor.

Skilled Nursing

Medicare Part A typically covers skilled nursing facility stays after at least 72 hours of inpatient hospital admission.

If you are admitted to a skilled nursing facility, your first 20 days should be covered in full, but after that, you’ll need to make a copay every day. This benefit lasts up to 100 days, after which you’ll be responsible for paying the bill 100% out-of-pocket.

Hospice

If you find yourself in the unfortunate situation to enter hospice care, you’ll likely want the best possible care available—whether at home or as an inpatient. Medicare Part A will cover your hospice care, including pain management and aid, nursing, and medical devices.

You may need to pay 5% of the cost of inpatient hospice care (if you choose inpatient care), and a $5 copayment for outpatient prescription drugs (for pain management and other symptoms). You may also have to pay for room and board if you choose to live in a facility.

How Does Medicare Part A Compare to Other Parts?

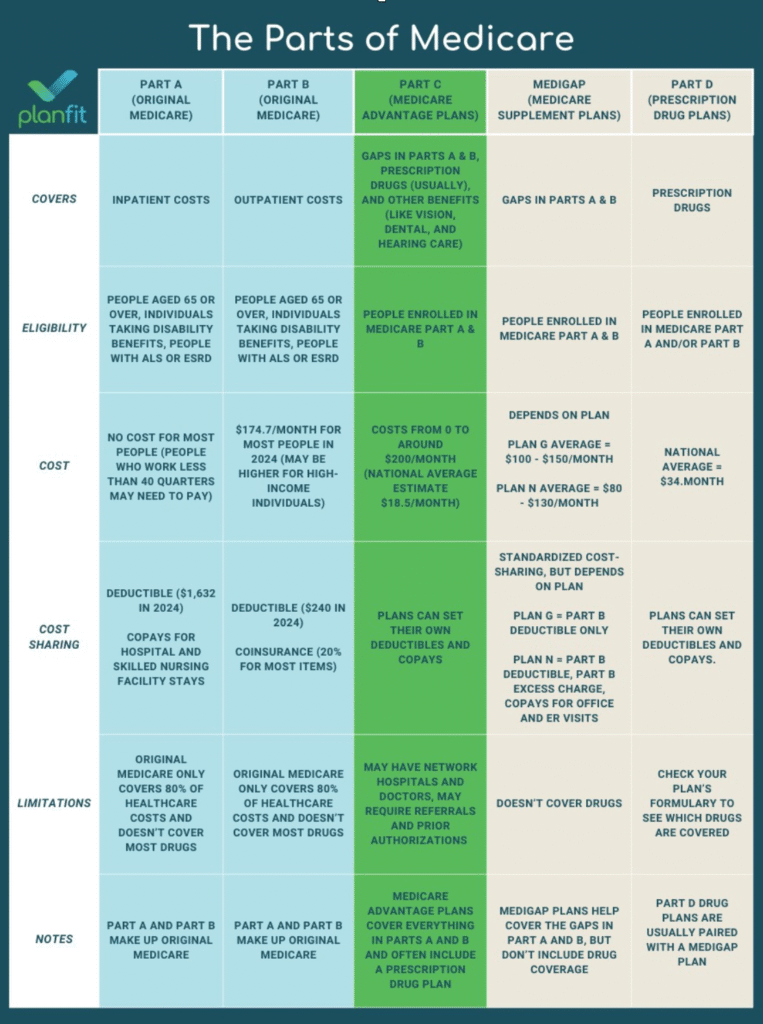

There are a lot of components involved in Medicare:

- Original Medicare, which is Part A and Part B

- Medicare Advantage Plans, which is Part C

- Medicare Prescription Drug Benefit, which is Part D

- Medicare Supplement Plans, which is a secondary insurance plan to Original Medicare

Medicare Part B

While Medicare Part A is hospital insurance, Medicare Part B usually covers 80% of medical expenses, such as X-rays, tests, and preventative treatments.

Cost: The base premium for Part B is set to $202.90 for 2026. However, how much you pay depends on your income bracket (known as Medicare IRMAA). Medicare Part B also has an annual deductible, which is set to $283 for 2026.

Medicare Part C

Medicare Advantage plans (also known as Medicare Part C) are provided by private insurance companies and offer coverage in addition to Original Medicare.

Medicare Advantage plans generally have lower monthly costs than Medicare Supplement Plans, and you typically have doctors and hospitals within your plan’s network (HMO plans) or pay higher copays if you go out-of-network (PPO plans). Many Medicare Advantage plans also offer additional features like vision, hearing, and dental care.

Cost:Medicare Advantage plans are typically either low-cost or zero-cost, depending on where you live.

Medicare Part D

Medicare Part D, also known as prescription drug plans, is a private insurance plan that usually covers prescription medications. You can get a prescription drug plan by enrolling in a Medicare Advantage Plan with a built-in Part D plan, or you can sign up for a prescription drug plan as a standalone plan.

Cost: The cost for prescription drug plans varies by location and provider. Standalone Prescription Drug Plans also have their own deductibles, copays, and coinsurance. Medicare Advantage Prescription Drug Plans (MAPDs) have Part D built into the plan.

Medicare Supplement Plans (Medigap)

Medicare Supplement (Medigap) Plans are a secondary insurance policy to Original Medicare. They help pay for the “gaps” in Original Medicare (the deductibles, copays, and coinsurance that you’re responsible for paying out-of-pocket).

Medicare Supplement Plans are also provided by private insurance companies. However, unlike Medicare Advantage Plans, these plans are standardized by the government. There are ten different Medicare Supplement Plans you can choose from, and they all provide the same coverage regardless of which company you get them from.

Medicare Supplement Plans usually don’t have networks. Also, most Medigap plans typically don’t include prescription drug coverage or dental, vision, and hearing care (you may need to get separate standalone plans for those).

Who Qualifies for Medicare Part A?

Medicare Part A is available for people aged 65 or over, those with disabilities, and those with end-stage renal disease. If you fit into one of those three categories, you may be able to enroll in Part A.

How Much Does Medicare Part A Cost?

If you’re over 65 and have been employed and paying payroll taxes for at least ten years, you typically don’t pay a monthly cost for Medicare Part A. We’ll cover the details on how to sign up for Medicare Part A later.

If you haven’t worked and paid Medicare taxes for 10 years, you can still enroll in Medicare Part A, but you may need to pay a monthly fee. In 2026, this could cost you between $311 and $565 monthly, depending on how long you paid Medicare taxes.

What Other Insurance Do You Need?

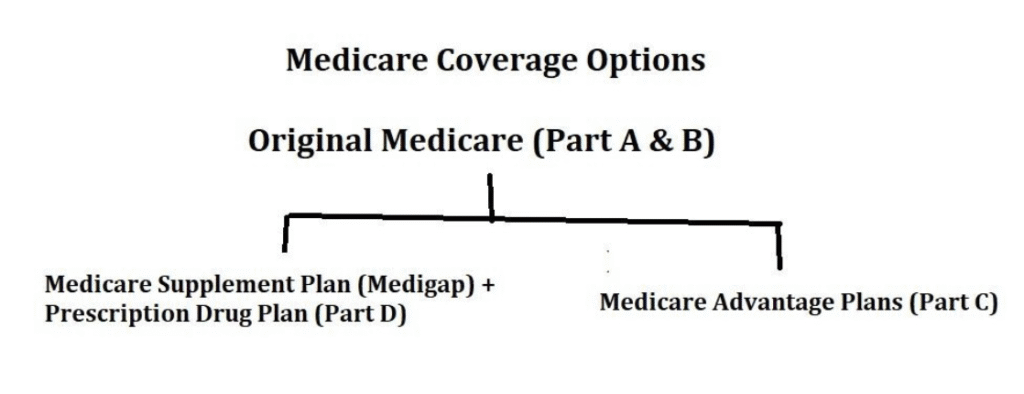

Original Medicare (Parts A and B) covers roughly 80% of your healthcare costs. To get coverage for the remaining 20%, you should consider enrolling in either a Medicare Advantage Plan (Part C) or a Medicare Supplement Plan plus a prescription drug plan (Part D).

Both options are provided by private insurance companies, and both could help to reduce your out-of-pocket spending for.

How to Sign Up For Medicare Part A

Signing up for Medicare Part A shouldn’t be too difficult, and you have options—you can do it at your local Social Security office, on their website, or over the phone.

[Ifavailable,let’sembedour“HowtoEnrollinMedicare”videohere]

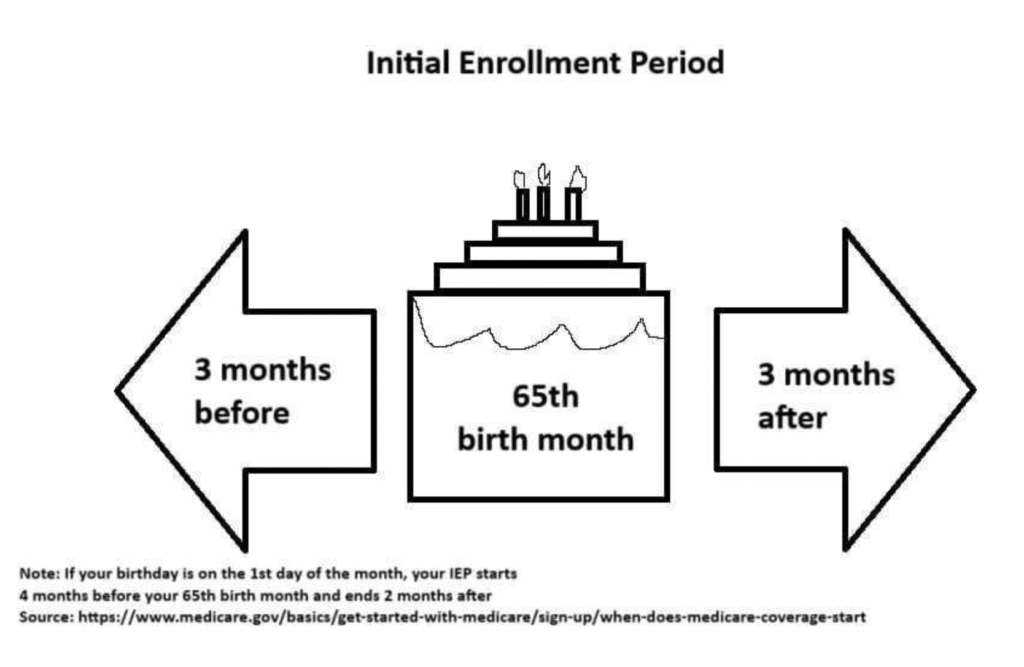

If you’re about to turn 65, you can typically sign up in the three months leading up to your birthday, the month of your birthday, and the following three months. If you miss this period, you’ll have to wait for the enrollment period, which happens between January 1 and March 31.

If you’re already on Social Security, you don’t have to worry about signing up at all, as you’ll automatically be enrolled on your 65th birthday.

Are There Ways to Save Money on Medicare Part A?

If you’re required to pay for Part A, there are two Medicare Savings Programs that could potentially help you:

Also, if you have to pay a premium for your Part A coverage, you should enroll during your Initial Enrollment Period to avoid penalties (unless you have creditable coverage).

If you delay enrolling in Part A and you do not have credible coverage, you could incur a permanent late enrollment penalty.

Conclusion

It’s important to remember that Medicare Part A doesn’t cover 100% of your hospital bills. There’s usually a deductible and copays that you’re responsible for paying out-of-pocket.

It also doesn’t typically cover any prescription drugs, hearing, vision, or dentistry, so most people opt to get additional coverage for these.

If you’re still not sure what plan is the best fit for you, you can watch our free workshop by clicking the button below—and it will help equip you with the knowledge to make the right decision for you: