How to Avoid Medicare Penalties: Stay Clear of These 6 Fees

As you approach age 65, you quickly realize that you have to prepare for Medicare—whether you plan to enroll in Medicare or not.

Because it’s true what they say:

If you don’t have creditable coverage and don’t enroll in Medicare on time, you may have to pay “lifetime penalty” fees. The longer you wait, the higher these penalties typically become.

There are many variables that determine when you should enroll in Medicare to avoid these fees, such as whether you have creditable coverage, your job status, whether you qualify for a Special Enrollment Period, and more.

That’s why in this article, we’ll go over these different factors so you can have a smooth transition into Medicare, and avoid these potentially expensive fees.

We’ll take a comprehensive look at:

- Medicare Part A penalties

- Medicare Part B penalties

- Medicare Part D penalties

- IRMAA fees for Medicare

- The Medigap penalty, and

- “Penalties” for not signing up for financial support

We’ll talk about how these fees are calculated, who’s exempt from these, and how you can avoid them.

All the Medicare Penalties – And How to Avoid Them

Medicare Part A Penalties

Unlike the other fees we’ll discuss, most people don’t have to worry about Medicare Part A penalties.

Medicare Part A covers your hospital costs. And most of the time, you won’t have to pay to have Medicare Part A because you’ve worked for years paying into Medicare to get this coverage.

However, if you or your spouse (or former spouse) are both people who haven’t worked for 40 calendar quarters (which is about 10 years of work), then you might have to pay either $278 or $505/month for Medicare Part A (depending on how many calendar quarters you’ve worked). What happens if you don’t enroll when you first become eligible?

You could get penalized with even more fees.

What is Medicare Part A’s Late Enrollment Fee?

If you don’t enroll in Medicare Part A’s initial enrollment period, and you don’t qualify for $0 premium Medicare Part A, you may get a 10% fee on top of your monthly costs (medicare.gov).

Note: if you’re covered by an insurance plan that pays first and then Medicare (such as an employer’s health plan), you may be able to delay enrolling in Part A without incurring a penalty. To learn more about how Medicare interacts with other insurance, visit Medicare.gov.

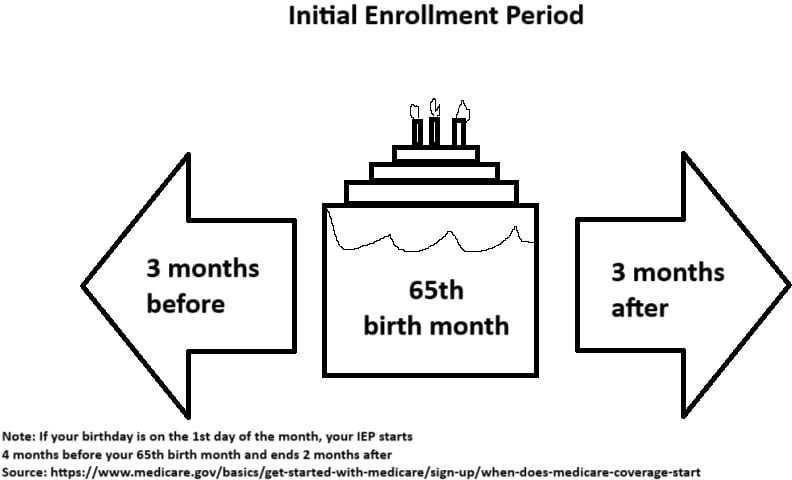

The initial enrollment period to enroll in Medicare Part A runs for seven months — the three months before the month you turn 65, the month you turn 65, and the three months after the month you turn 65.

For instance, if you’re born on September 20, you can enroll as early as June 1, and as late as December 31.

However, if you’re born on the first day of a month, the enrollment period will be 4 months before your birth month, and two months after (medicare.gov).

So if you’re born on August 1, your enrollment period will be April 1 to October 31.

Remember! If you, your spouse, or former spouse have worked for 40 calendar quarters (10 years), the Medicare Part A fee most likely doesn’t apply to you.

Is Medicare Part A’s Late Enrollment Fee Permanent?

No. Unlike Medicare Part B and Medicare Part D penalties, you will eventually pay off Medicare Part A’s penalty.

The penalty lasts 2x as many years as you didn’t sign up.

- 1 year late = 10% for 2 years

- 2 years late = 10% for 4 years

- 3 years late = 10% for 6 years

And so on.

Again, this isn’t something most people have to worry about, it’s just good to be aware of it! Now let’s move to a more common penalty to encounter…

Medicare Part B Penalties

One of the most frustrating fees to get hit with is the Medicare Part B late enrollment penalty (LEP).

Medicare Part B is the medical insurance part of Medicare. And unlike Medicare Part A, almost everyone has to pay premiums for this.

What happens if you don’t sign up on time?

You’ll typically be hit by the late enrollment fees, which last forever (or until you stop Medicare, but who does that?).

That’s why if you don’t have creditable coverage, it’s critical to enroll for Medicare Part B as soon as you become eligible.

Do You Have to Enroll in Medicare Part B If You Have Insurance Through Work? (Creditable Coverage)

No. If you are covered by your (or your spouse’s) job’s health insurance, you may not need to enroll in Medicare Part B during the initial enrollment period (medicare.gov).

This is one of the exemptions for the Medicare Part B penalty.

However, once your group health coverage ends, OR you lose your employment, you have eight months to enroll for Medicare Part B. If you miss this period, you’ll get the same 10% penalty fee for every year you don’t sign up.

If you choose to delay enrolling in Medicare because you had creditable coverage from an employer (or spouse’s employer), you should submit the CMS L564 and CMS 40B forms once you enroll in Medicare. These forms show Medicare that you had creditable coverage, so you won’t be subject to the Medicare Part B late enrollment penalty.

You may need the HR department of your (or your spouse’s) company to fill out and sign the CMS L564 form. If your employer is unable to do this, you can also fill out the form yourself, but you will need to provide secondary evidence (such as receipts, income tax returns, or pay stubs showing health insurance premium payments or deductions).

Also, before you turn 65, it’s a good idea to confirm with your employer’s insurance company whether or not your plan is considered “creditable” and you don’t have to enroll in Part B. Many times you won’t, but there are several instances where your coverage isn’t considered creditable.

How to Avoid The Medicare Part B Penalty

To avoid this penalty, enroll for Medicare Part B in your Initial Enrollment Period if you don’t have creditable coverage and plan to go on a Medicare insurance plan. Like Medicare Part A, this runs for the three months before the month you turn 65, the month you turn 65, and the three months after the month you turn 65 (medicare.gov).

Like Medicare Part A, if you’re born on the first day of the month, your enrollment period runs four months before your 65th birthday and two months after (medicare.gov).

For example:

- Birthday: August 1

- Start of Enrollment: April 1

- End of Enrollment: October 31

Enroll on time or maintain your creditable coverage, and you won’t ever have to worry about that pesky permanent Medicare Part B fee!

How Medicare Part B Late Enrollment Fees Are Calculated

You’ll pay an extra 10% for every year you don’t enroll for Medicare Part B while being eligible.

If you’re one year late to sign up, 10%.

- years late, 20%.

- years late, 30%. And so on.

The amount is also rounded off to the nearest $0.10.

Let’s say you sign up three years late. The Medicare Part B premium for 2026 is $202.90/month. This means that you’ll have to pay $263.77 every month.

$202.90 + $60.87 (30% of 202.90, rounded) = $263.77

Ouch.

Are There Other Exemptions to the Medicare Part B Penalty?

Yes. According to medicare.gov, aside from having creditable medical insurance, you also won’t get a penalty for missing your initial enrollment period if you:

- Lost your Medicaid coverage

- Weren’t able to sign up during the initial enrollment period due to a natural disaster

- Weren’t able to sign up because you got the wrong information from your health plan or employer

- Weren’t able to sign up because you were in jail

- Weren’t able to sign up because of “exceptional conditions”

- Are a volunteer and serve in another country

- Have TRICARE

Note: the first four of these typically only apply if it happened to you on January 1, 2023, or after!

For most of these, you’ll normally get a Special Enrollment Period (SEP), where you can enroll within a given timeframe.

If you don’t enroll within your SEP, you’ll usually get the 10% late enrollment penalty (LEP) for every year you miss!

To learn more about these special cases, you can check out Medicare’s website.

Why Does Medicare Charge Permanent Fees If You Sign Up Late?

Note: this section is an opinion based on experience in the field. Medicare does not explicitly mention why there is a late enrollment penalty.

Medicare relies on healthy people paying their monthly fees to offset the cost of paying for sick people’s treatment. This may be why if you join too late, they’ll charge you significantly more to make up for the payments you could’ve made if you enrolled earlier.

They also make it a permanent fee, probably to give an extra nudge for people to sign up on time.

This same reasoning may apply to the Medicare Part D and A penalties as well.

It might seem like they’re trying to punish you, but if you think about it, these fees actually make sense.

If everybody joined when they were older and closer to needing Medicare’s assistance, there might not be enough payors to support everyone’s assistance.

Medicare Part D Penalties

Next, let’s take a look at Medicare Part D penalties.

Medicare Part D covers prescription drug costs. You can enroll for it separately, or you can get a Medicare Advantage plan that includes Part D.

Now here’s the thing…

Everyone knows they need to sign up for Original Medicare (a.k.a Medicare Parts A and B).

But too many people don’t realize that if they don’t sign up for the “optional” Medicare Part D on time, they’ll also receive a penalty that lasts “forever” if they eventually decide to get Medicare Part D.

Let’s take a closer look!

How to Avoid the Medicare Part D Penalty

To avoid penalties, sign up for Medicare Part D during your initial enrollment period if you don’t have creditable drug coverage! This is the same seven-month window for enrolling in Medicare Parts A and B.

This shows how important it is to know when you’re eligible. You can avoid all three penalties by signing up on time!

Note: To enroll for Medicare Part D, you’ll typically need to enroll in Medicare Parts A and/or B first.

How Much is the Medicare Part D Late Enrollment Penalty?

You’ll get an additional 1% on the national base premium for every month you don’t have Medicare Part D coverage (medicare.gov).

According to Medicare.gov, the national base premium for 2026 is $38.99. However, keep in mind that Medicare Part D drug plans can charge as high or as low as they want—they don’t have to use the national base premium.

So let’s say you don’t get Medicare Part D coverage for 15 months since you first became eligible. This means you’ll have to pay a 15% fee on the national base premium for as long as you have Medicare Part D coverage (even if you switch plans!).

So if you have a $25/month plan, you’ll have to pay $30.80/month for your Medicare Part D coverage:

$25 + $5.80 (15% of 38.99, rounded) = $30.80

$5.80 might not sound like a lot but it definitely adds up!

In one year, that’s an extra $69.60 that you wouldn’t have to spend if you signed up on time.

Do I Need to Sign Up for Medicare Part D If I Have Drug Coverage?

No, you don’t have to sign up for Medicare Part D if you have a creditable drug plan (a plan with a similar or higher value than Part Medicare D).

This can be from your employer, TRICARE, your health insurance, and certain others.

As long as it provides the same level of coverage as Medicare Part D or better (according to Medicare), you normally can skip enrolling in Medicare Part D without worrying about penalties later on.

However!

If your drug coverage ends, you’ll need to sign up for Medicare Part D within 62 days to avoid the late enrollment penalty! After 62 days, you’ll get an extra 1% penalty for every month you don’t sign up.

Who Is Exempt From The Medicare Part D Late Enrollment Penalty?

Aside from people with similar drug coverage, people who are on Medicare’s “Extra Help” program are also typically exempt from the Medicare Part D penalties.

Extra Help is a program that helps low-income people pay for their Medicare Part D premiums, copays, coinsurance, and deductibles.

If you’re on this program, you also don’t have to worry about the Medicare Part D penalty at all. Here are the numbers to qualify for Extra Help in 2026:

Individuals:

- Income below $23,475/year

- Resources below $18,090 (Money, stocks, and bonds)

Married couples:

- Income below $31,725/year

- Resources below $36,100

To learn more about Extra Help, check out Medicare’s website! You can also enroll in Extra Help online here.

IRMAA Fees—and Tricks to Avoid Them

Now let’s get to a more complicated fee that some people have to pay: Medicare’s “Income-Related Monthly Adjustment Amount,” or IRMAA.

On paper, it sounds fair enough: People who make more money have to pay higher premiums.

However, this is typically done in strict income brackets. If you go just one dollar above the line, you’ll normally pay a lot more.

Depending on your income bracket, you could pay an additional $81.20 to $487.00 a month for Medicare Part B and an additional $14.50 to $91 for Medicare Part D (medicare.gov).

But here’s the good news.

There are strategies you can use to avoid getting into higher income brackets.

So, let’s take a deeper look at IRMAA, how it works, and how to avoid higher monthly payments!

How Is IRMAA Calculated?

To determine your IRMAA bracket, Medicare typically uses your modified adjusted gross income (MAGI) amount on your income tax return from two years ago.

This normally includes all taxable income, such as salary, 401 (k)s, IRAs, savings, and Social Security. It doesn’t typically include withdrawals from Roth 401 (k)s and Roth IRAs.

A quick example: For 2026, Medicare would usually use your 2024 tax return to determine your premiums. If you made $109,000 or below in 2024, you wouldn’t need to worry about being bumped up a bracket

Of course, the numbers change if you file a joint tax return with your spouse or a married and separated tax return with a former spouse.

The numbers also usually change every calendar year, so here are the Medicare Part B and Part D rates for 2026!

2026 Medicare IRMAA Income Brackets (Medicare Part B and Part D)

How to Avoid IRMAA Fees: Six Tricks You Can Use

Here are six ways to help avoid IRMAA fees:

- Max out your 401 (k) and IRA

- Transfer money from traditional 401(ks) and IRAs to Roth Accounts

- Spread out cash withdrawals

- Appeal the IRMAA fee

- Donate to charity

- Delay Social Security income until 70

The secret lies in bringing down your MAGI (modified adjusted gross income). How?

Let’s have a look at your options!

Method #1 – Max Out Your 401 (k) and IRA

If you’re still working, you could put as much money as possible into your 401(k) and IRA.

Your contributions to traditional 401(k)s and IRAs are made pre-tax. This means that anything you put into these accounts won’t add to your MAGI.

However, keep in mind that when you withdraw from a traditional 401(k) and IRA, it’s taxed as normal income.

That’s why you would slowly withdraw from your 401(k)s and IRAs. You’ll typically pay less taxes and, once again, it can help you avoid IRMAA.

Method #2 – Transfer Money from Traditional 401(k)s and IRAs to Roth 401(k) and IRAs

Method two works in the opposite direction of method one.

Instead of stuffing your 401(k)s and IRAs to avoid raising your MAGI, you could instead transfer some of your money into Roth 401(k)s and IRAs.

What’s the difference?

Unlike traditional accounts, Roth contributions are taxed upfront. This means that any money you put into a Roth account will bring up your MAGI.

However, withdrawing from a Roth account is completely tax-free if you’re over 59 ½ years old! Remember, IRMAA counts the MAGI from two years ago.

So if you’re not yet 63 years old, this might be a good time to stuff your Roth 401(k) and IRA. Your contributions won’t affect IRMAA when you get Medicare. And you can withdraw your money later on without it affecting IRMAA!

Of course, you’ll need to do more precise calculations to find out if this is the best path to take for you.

Talk with a financial advisor to see if lowering your MAGI to avoid IRMAA is the best path forward.

Method #3 – Spread Out Cash Withdrawals

If you have cash in a traditional 401(k) or IRA, you could strategically spread out your withdrawals.

Let’s say you need $70k to purchase something big.

Instead of withdrawing it all in one go, you could strategically withdraw half in December, and the other half in January.

Since these withdrawals are taxable, doing it all in one go can spike your MAGI.

But strategically doing it in different calendar years could allow you to enjoy the same amount without that big MAGI jump (that will reduce your IRMAA two years down the line).

Method #4 – Appeal The IRMAA Fee

Let’s say you were earning well over $103k when you were 63.

But then something terrible happened, and you lost that income before you turned 65.

Then out of nowhere, Medicare slaps you with a hefty IRMAA fee because of how much you made two years ago.

What do you do?

The good news is that if you’re no longer earning as much as you were two years ago, you can appeal the IRMAA fee.

Here are the valid reasons you can appeal:

- Marriage

- Divorce

- Retirement (you or your spouse)

- Reducing working hours (you or your spouse)

- Natural disaster, disease, fraud, or other involuntary loss of income-producing property

- Pension loss

- Employer’s bankruptcy

You can appeal your IRMAA fees to the Social Security Administration.

Method #5 – Donate to Charity

It’s well-known that donating to charity can help reduce your taxes.

But what many people don’t realize is that charitable donations typically also reduce your MAGI. This, in turn, can help you avoid IRMAA altogether.

Remember, the IRMAA fees are monthly, so they can add up very quickly. There are also fees for Medicare Parts B and D.

If a donation to charity puts you below the first bracket of IRMAA, it may save you money.

However, before donating to charity to reduce your IRMAA, talk with an accounting professional to learn more about how this will affect your finances.

Method #6 – Delaying Social Security Until 70

Here’s the thing about MAGI:

Unlike AGI (Adjusted Gross Income), it also includes your non-taxable Social Security perks.

This means that if you claim your Social Security retirement perks, it can push you into a higher IRMAA bracket.

That’s why if ever you don’t need this aid, it might be a good idea to leave it.

Not only will you avoid IRMAA, but every year you don’t claim your Social Security credits, it can grow your monthly payments by 8%.

However, this growth stops once you turn 70. So that’s probably a good time to claim your retirement perks!

The “Medicare Supplement Penalty”

After getting Original Medicare (Medicare Parts A and B) on time, most people enroll in either a Medicare Advantage Plan or a Medicare Supplement Plan (Medigap).

Both of these can drastically lower your out-of-pocket costs by taking care of your coinsurances, copayments, and deductibles.

However, if you choose to go the Medigap route, there’s one big penalty that you need to be aware of. Because once you get it, it can be impossible to reverse!

We’re talking about missing the Medigap Open Enrollment Period. While this technically isn’t a fee, it can be very costly for you.

So what exactly is it?

Let’s start from the beginning:

What Are Medicare Supplement Plans?

Medicare Supplement Plans are known as Medigap plans provided by private insurance companies to complement Original Medicare. Although they’re provided by private companies, the government typically standardizes these plans (unlike Medicare Advantage plans).

You can choose from Medicare Supplement (Medigap) Plans A, B, C, D, F, G, K, L, M, and N. Each plan offers varying levels of coverage.

However, the most 2 most commonly chosen Medicare Supplement plans in 2026 are Plan G and Plan N.

Note: these plans are also called Medicare Supplemental Plans. The names Medigap and Medicare Supplement Plan are interchangeable.

What is the Medigap Open Enrollment Period?

The Medigap Open Enrollment Period is a six-month window where you can sign up for any Medigap plan. This window starts when you first start Medicare Part B. (You can find this and the following “Open Enrollment Period” information on medicare.gov.)

Now here’s the interesting thing:

During this period, insurance companies are required by law to accept your application. They are not allowed to refuse your coverage for ANY health-related issues. And they must also give the plan to everyone (of the same age) at the same price.

As long as you’re in their coverage area, they legally can’t deny you coverage, EVEN if you have a pre-existing condition!

It doesn’t matter how healthy you are, these private insurance companies cannot turn you away or charge you more than others.

This brings us to our next point…

What Happens If You Miss the Medigap Open Enrollment Period?

If you miss the Medigap Open Enrollment Period, insurance companies are typically no longer legally required to provide you coverage.

You can still apply for a Medicare Supplement (Medigap) Plan at any time. But if you do this after the Medigap Open Enrollment Period, companies will usually ask you health-related questions.

Answer “yes” to any of these questions, and most insurance companies will deny you coverage. It’s very difficult to get a Medigap policy if you already have a condition.

Even if they accept your application, they may charge you significantly more. That’s why the Medigap Open Enrollment Period is important to know about.

If you miss it and a Medigap plan won’t accept you, you can typically still enroll in a Medicare Advantage Plan.

But if you want to enroll in a Medigap plan, be aware of the Medigap Open Enrollment Period!

“Penalties” For Not Signing Up For Financial Support?

Last, but not least, let’s consider the cost of not knowing all your assistance options. These aren’t officially penalties.

However, if you have the opportunity to save money on Medicare and you don’t take it — isn’t that virtually the same as paying a fee?

That’s why we’re adding your financial support options here!

Note: These financial assistance programs are usually only available for people with lower incomes! Also, most programs have different terms depending on which state you live in.

Medicaid’s Medicare Savings Programs (MSPs)

People with low income and resources can often enroll in their state’s Medicaid program to help pay for Medicare costs! There are four levels of Medicaid, also known as Medicare Savings Programs (MSPs) that you can sign up for if you meet the criteria, according to medicare.gov:

- Qualified Medicare Beneficiary (QMB) Program – The QMB program covers your Medicare Part A and Part B premiums. If you’re enrolled in QMB, healthcare providers are also not usually allowed to charge you for items Medicare covers, like coinsurance, copays, or deductibles. To qualify for QMB in 2026, you typically need to have a monthly income below $1,325 (individuals) or $1,783 (couples). You also need to have resources below $9,950 (individual) or $14,910 (couples).

- Specified Low-Income Medicare Beneficiary (SLMB) Program – The SLMB program usually has a higher income limit than QMB, but it will only cover your Medicare Part B premiums. The limits for SLMB in 2024 are $1,585 (individuals) or $2,135 (couples). And the resource limits are $9,950 (individuals) and $14,910 (couples).

- Qualifying Individual (QI) Program – Like SLMB, QI only covers your Medicare Part B premiums. It has higher income limits, but you have to sign up for this program every year. Also, registrations are done on a first-come, first-serve basis. The monthly income limits for QI are $1,781 (individuals) and $2,400 (couples). With resource limits at $9,950 (individuals) and $14,910 (couples).

- Qualified Disabled and Working Individuals (QDWI) Program – QDWI is a program that pays for Medicare Part A premiums. It’s a program that few people qualify for. But if you are disabled, are working, and you lost your Social Security disability perks and Medicare $0 premium Part A, then you can potentially sign up. Monthly income limits for

the QDWI program are $5,302 (individuals) and $7,135 (couples). While the resource limits are $4,000 (individuals) and $6,000 (couples).

Extra Help

If you meet the income requirements, you can potentially enroll in the Extra Help program to help cover drug costs. Extra Help works with your Medicare Part D coverage. Together, they could drastically reduce your expenses for your meds.

According to medicare.gov, to qualify for Extra Help, your yearly income should be below

$23,475 (individuals) or $31,725 (couples), with resources below $18,090 (individuals) or

$36,100 (couples).

Normally, you also automatically qualify for Extra Help if you:

- Are on full Medicaid coverage

- Are part of the QMB, SLMB, or QI program

- If you get Supplement Security Income from Social Security

To learn more about Extra Help, you can visit Medicare’s official website.

Other Financial Support Options

There are also other ways you could receive financial support for your healthcare costs. Additional financial assistance programs include:

- Medicare-Medicaid Plans (MMP) – In some states, the federal government and state governments are working to create MMP plans that have even more coverage (such as drug coverage). These plans are still experimental, but if you live in California, Illinois, Massachusetts, Michigan, New York, Ohio, Rhode Island, South Carolina, or Texas, you may qualify to enroll.

- State Pharmaceutical Assistance Programs – Another program offered by some states to help pay for drug costs. Eligibility and assistance vary by state. You may contact your state’s Medicaid office for inquiries.

- Pharmaceutical Assistance Programs – Some major pharmaceutical manufacturers offer assistance programs for low-income people with Medicare Part D coverage.

- Supplemental Security Income (SSI) – Last, but not least, Social Security! SSI is a monthly payment given to people aged 65 and above who have little or no income and resources. You may visit Social Security’s website to check if you qualify.

How to Approach Medicare Before Turning 65

Medicare can be daunting.

There are SO many things you have to know before turning 65, and it’s your own responsibility to understand them in order to make the right decisions! You’re not going to get a pass on these penalties just because you didn’t know they were there.

That’s why studying how to avoid Medicare fees is a critical step to take early on in your Medicare journey.

By reading this article, you’re already well aware of what potential fees you could get stuck with, and how you can avoid them!

That said, we highly encourage you to do your own research into Medicare and your risk of getting stuck with fees.

If you need help, contact our team of licensed insurance agents at PlanFit to learn how to save as much money as possible on Medicare, while still getting the coverage that’s right for you: