- Medicare Part B is the part of Medicare that covers your medical costs. Together with Medicare Part A (hospital coverage), these two parts form Original Medicare.

- People typically become eligible to enroll in Medicare Part B when they turn 65. If you don’t have creditable coverage (such as some employer health plans) and you delay enrollment, you may incur permanent late enrollment penalties on your Medicare Part B premiums.

- In 2024, Medicare Part B costs $174.7/month, has a $240 deductible, and has a 20% coinsurance that you need to pay for most covered services and items.

- After enrolling in Medicare Part B, most people may also consider enrolling in either a Medicare Advantage Plan, or a Medicare Supplement Plan + Medicare Part D drug plan to help cover the gaps in Original Medicare’s coverage.

Medicare Part B is one of the most critical parts of Medicare to understand.

Yes, it can be confusing, but if you are not fully aware of its rules and regulations, you could get expensive penalties that’ll last for the rest of your life!

Sound scary?

Well… there’s no need to panic. If you know what you’re doing, Medicare Part B can save you from ghastly medical bills.

In this complete Medicare Part B overview, we’re going to explain everything you need to know—in plain english.

We’ll go over:

1. What Medicare Part B is,

2. what Medicare Part B covers,

3. who’s eligible for Medicare Part B,

4. when and how to enroll in Medicare Part B,

5. what Medicare Part B costs,

and what other plans should you consider enrolling in aside from Medicare Part B.

What is Medicare Part B?

Medicare Part B is the branch of Medicare that helps cover your medical costs. It mainly covers doctor office visits, home health services, medical equipment, preventive services, and more. Together with Medicare Part A (hospital coverage), these two form Original Medicare.

Original Medicare (Parts A and B) is the cornerstone of Medicare. These are the two main parts that are provided directly by the federal government. Most other Medicare plans that supplement Original Medicare are provided by a

What Does Medicare Part B Cover?

In a nutshell: Medicare Part A covers your inpatient hospital needs, while Medicare Part B covers most other things deemed “medically necessary.”.

But if you’re wondering what that means, you can split Medicare Part B coverage into seven categories:

● Medically necessary services – services that are required to diagnose and treat your condition.

- Preventive services– services that help detect and prevent illnesses before they rise up (ex: wellness checks, disease screenings, and some vaccinations)

- Clinical research– if you are taking part in clinical research, Medicare Part B may help cover your costs

- Ambulance services– Medicare Part B typically handles the cost of ambulances in emergencies and medically necessary ambulance transfers

- Durable medical equipment (DME) – if your Medicare-enrolled doctor prescribes a DME – such as canes, blood sugar meters, or wheelchairs – Medicare Part B could help cover the cost

- Mental health – including inpatient, outpatient, partial hospitalization, and intensive outpatient program services relating to mental health

Some prescription drugs– a limited number of drugs administered in special conditions. (Medicare Part B prescription drug coverage is limited. That’s why many people enroll in a Medicare Part D prescription drug plan to cover your prescription medications.)

Note: Aside from preventive services,Medicare Part B will usually charge you a 20% coinsurance payment for most of these items and services.

You might be wondering who decides what’s “medically necessary.”

Medicare has a list of items and services that must be covered in all states. Outside of Medicare’s list, coverage differs based on your location.

To find out if Medicare covers a specific service, ask your doctor or healthcare provider before getting treatment!

What Does Medicare Part B Not Cover?

Medicare Part B doesn’t cover most prescription drugs, vision, dental, and hearing care, and long-term care.

- Prescription Drugs – Aside from very few specialized drugs administered in special conditions, Medicare Part B won’t cover your prescription medications. That’s why it might be a good idea to consider enrolling in a separate Medicare Part D drug plan or a Medicare Advantage plan (more on this later).

- Vision, Dental, and Hearing Care – Medicare Part B will cover some screenings for diseases (such as glaucoma tests). Medicare will also cover your treatment if you have a disease or condition in your eyes, mouth, or ears. However, general needs like glasses, tooth extractions, or hearing aids aren’t covered by Medicare. You could get a Medicare Advantage plan that includes these things, or enroll in a separate vision-dental-hearing insurance.

- Long-Term Care – Medicare Part B doesn’t cover long-term care, such as nursing home stays or any custodial care. Long-term care is also not covered by Medicare Supplement plans or Medicare Advantage plans. To get coverage for this, you may want to look at enrolling in Medicaid, which has different qualifications for each state.

For everything else, make sure to call your doctor or healthcare provider and ask if Medicare Part B will help cover the costs.

Who is Eligible For Medicare Part B?

American citizens who are aged 65 and over, have a disability, or have ESRD (end-stage renal disease) or ALS (amyotrophic later sclerosis), may be eligible to enroll in Medicare Part B.

Non-US Citizens may also enroll in Medicare if they have a permanent residence in the country, and meet the other requirements for Medicare:

- Age 65 and above – Most people enroll in Medicare when they turn 65. You are not required by law to enroll when you turn 65, but you may incur permanent penalties if you choose to delay enrolling in Medicare Part B without creditable coverage or one of the accepted reasons for delaying (more on this below).

- Disabilities – If you are receiving disability payments from Social Security or the Railroad Retirement Board, you are eligible to sign up for Medicare Part B after a two year waiting period, even if you aren’t aged 65 yet.

- ESRD and ALS – If you are diagnosed with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), you can sign up for Medicare Part B, regardless of your age.

Medicare Part B Enrollment

Unless you have other creditable coverage, you may want to enroll in Medicare Part B during your Initial Enrollment Period (IEP) to avoid permanent penalties.

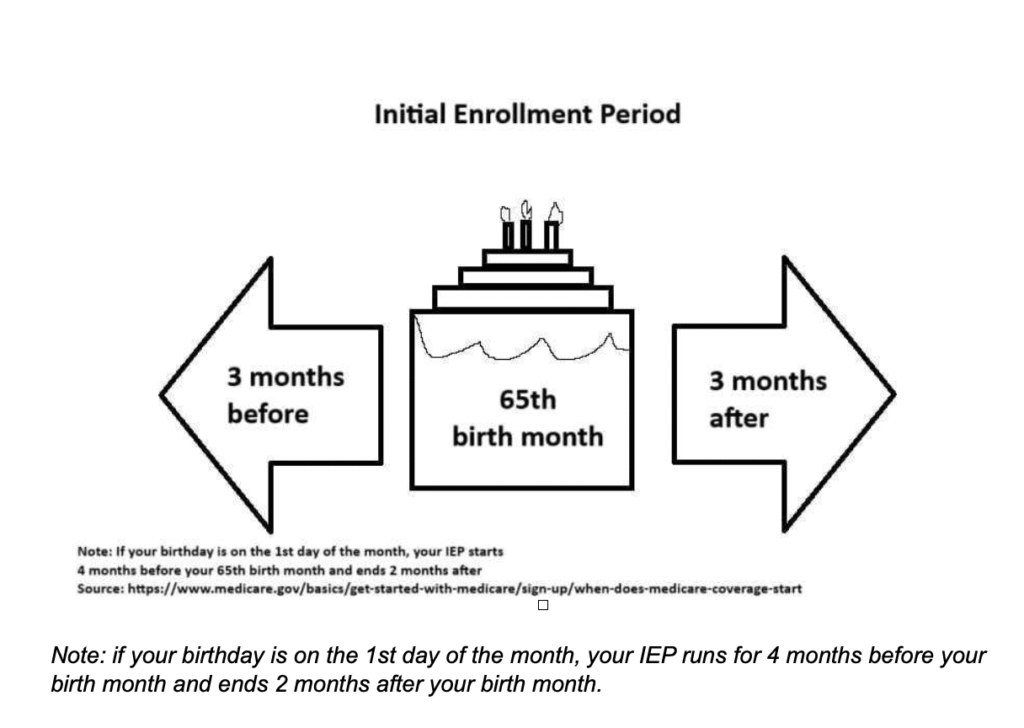

Your IEP runs for 7 months—starting 3 months before your 65th birth month, including your birth month, and ending 3 months after your 65th birth month.

This means that if you turn 65 on October 6, your Initial Enrollment Period starts on July 1, and ends on January 31.

Note: if your birthday is on the 1st day of the month, your IEP runs for 4 months before your birth month and ends 2 months after your birth month.

Medicare Part B Late Enrollment Penalty

If you miss your Initial Enrollment Period and don’t have creditable coverage, you may get a 10% increase in your Medicare Part B premiums for every year you delay.

However, there are some special situations where you won’t get this penalty if you miss your IEP:

- If you or your spouse are covered by your employer’s health plan (as long as the coverage is considered creditable coverage),

- You lost your Medicaid coverage,

- You weren’t able to sign up during the initial enrollment period due to a natural disaster,

- You weren’t able to sign up because you got the wrong information from your health plan or employer,

- You weren’t able to sign up because you were in jail,

- You weren’t able to sign up because of “exceptional conditions,” or

- You are a volunteer and serve in another country.

All of these situations will give you a Special Enrollment Period (SEP). If you don’t enroll during your SEP, you’ll get the same 10% penalty for each year you delay.

To learn more about these SEPs and the forms you need to submit to avoid penalties, you can visit Medicare’s website.

How Do You Enroll in Medicare Part B?

To enroll in Medicare Part B, you can:

- Enroll online through ssa.gov,

- Call Social Security at 1-800-772-1213 or 1-800-325-0778 (TTY), or

- Call the Railroad Retirement Board at 1-877-772-5772 (if you or your spouse worked for a railroad).

Note: if you start getting Social Security or Railroad Retirement perks at least 4 months before turning 65, you’ll automatically be enrolled in Medicare Part A and B.

What Does Medicare Part B Cost?

Medicare Part B costs $174.7/month for most people in 2024. However, there are other costs associated with Medicare Part B that you need to know about:

| Item: | 2024 cost: |

| Premium – the monthly cost to keep Medicare Part B | $174.7/month* *People in higher income brackets pay more, see the IRMAA table below |

| Deductible – the amount you need to spend out-of-pocket before Medicare Part B starts covering your costs | $240 |

| Coinsurance – the percentage of costs that you are required to pay out-of-pocket | 20% for most Medicare Part B covered items and services |

| Excess Charge – the amount that some healthcare providers charge over the Medicare-approved amount (you are responsible for paying this in full) | Up to 15% of the Medicare-approved amount |

If you enroll for Medicare Part B late and don’t have creditable coverage, you’ll also incur permanent penalties on your monthly costs. This is an additional 10% for every year you delay!

Medicare Part B IRMAA Income Brackets

Here’s how much your Medicare Part B premium will be, based on your income:

| Individual Tax Return | Joint Tax Return | Married & Separated Tax Return | Additional fee (total monthly premium) |

| $103,000 & below | $206,000 & below | $103,000 & below | $0 ($174.7) |

| $103,001 – $129,000 | $206,001 – $258,000 | N/A | + $69.9 ($244.6) |

| $129,001 – $161,000 | $258,001 – $322,000 | N/A | + $174.7 ($349.4) |

| $161,001 – $193,000 | $322,001 – $386,000 | N/A | + $279.5 ($454.2) |

| $193,001 – $499,999 | $386,001 – $749,999 | $103,001 – $396,999 | + $384.3 ($559) |

| $500,000 & above | $750,000 & above | $397,000 & above | + $419.3 ($594) |

Note: your IRMAA is taken from your Modified Adjusted Gross Income (MAGI) in your tax return from two years ago. If you are earning significantly less now than two years ago, you can appeal your income bracket. To learn more, you may read the IRMAA section of my How to Avoid Medicare Fees article.

How Does Medicare Part B Pay For Your Healthcare?

There are typically two ways Medicare Part B pays for your healthcare:

- Your provider bills Medicare directly, or

- You pay the bill first, then request reimbursement from Medicare

“Medicare Assignment” is an agreement between Medicare and healthcare providers to charge patients the Medicare-approved amount for items and services. There are generally three types of healthcare providers:

- Participating Providers – Healthcare providers who accept Medicare Assignment and who should charge only the Medicare-approved amount

- Non-Participating Providers – Healthcare providers who don’t accept Medicare Assignment, and may or may not charge the Medicare-approved amount on a case-by-case basis

- Opt-Out Providers – Healthcare providers that don’t accept Medicare as payment.

Participating providers should bill Medicare directly. Since they take Medicare Assignment, they shouldn’t charge you over the Medicare-approved amount. These facilities will only bill you for your deductible (if it isn’t paid yet), and any coinsurance you’re responsible for.

Non-participating providers may or may not bill Medicare directly. You can ask them to, but if they refuse, you may have to pay the bill upfront and request reimbursement from Medicare.

Non-participating providers that don’t accept Medicare Assignment may also charge you up to 15% more than the Medicare-approved amount. The excess amount is known as the Part B excess charge, and you’re responsible for paying it.

Finally, doctors, facilities, suppliers, and other healthcare providers that opt out of Medicare can charge you as high or as low as they want. Medicare will generally NOT cover you if you go to these providers except in emergencies.

That’s why it’s important to ask if your healthcare provider accepts Medicare Assignment.

What Other Plans Do People Typically Look at Aside From Medicare Part B?

Medicare Parts A and B are great.

However, having Original Medicare alone isn’t considered the wisest decision.

This is because even though Original Medicare typically covers roughly 80% of your healthcare costs, there’s no cap on how much the remaining 20% will be.

If you get a serious disease or condition, you can easily end up spending well over $10,000 in hospital and medical bills (it might even reach over $100,000 in some cases).

That’s why aside from enrolling in Medicare Parts A and B, most people enroll in a Medicare Advantage Plan, or a Medicare Supplement + Medicare Part D plan.

Both of these options will usually handle most of the remaining 20% and will often cap your yearly out-of-pocket spending.

Medicare Part C Advantage Plans

Medicare Part C (also called Medicare Advantage Plans) are provided by private insurance companies. Medicare Advantage Plans must include everything covered by Medicare Parts A and B. Aside from that, Medicare Advantage Plans are not standardized, which allows each insurance company to decide how much additional coverage they include in their plans.

To sign up for a Medicare Advantage Plan, you’ll need to be enrolled in both Medicare Part A and B.

Medicare Advantage Plans typically have lower monthly payments, and some even charge you $0/month!

Some Medicare Advantage Plans may also include drug coverage, and benefits for vision, dental, and hearing care.

Most Medicare Advantage Plans have networks. This means that these plans partner up with several local doctors and hospitals in your area to provide low-cost healthcare. If you get your healthcare outside your plan’s network, you may have higher cost-sharing, or your plan may not cover you. Medicare Advantage Plans sometimes also require referrals and pre-authorizations before you can get special treatment.

Finally, each Medicare Advantage Plan has different costs, such as deductibles, copays, and coinsurance payments.

Medicare Supplement (Medigap) Plans

Medicare Supplement (Medigap) plans are secondary policies to Original Medicare. They help cover most of the coverage “gaps” in Original Medicare, such as the deductibles, coinsurances, and excess charges of Part B.

Medicare Supplement (Medigap) Plans are also provided by insurance companies. However, these plans are standardized by Medicare, meaning you’ll get the same coverage regardless of which company you get your Medigap policy from.

Medicare Supplement (Medigap) plans also typically don’t have networks, meaning your Medigap plan will cover you for any doctor or hospital in the U.S. that accepts Medicare.

There are 10 Medigap Plans to choose from: Plan A, B, C, D, F, G, K, L, M, and N.

The premiums of Medicare Supplement (Medigap) Plans are generally higher than that of Medicare Advantage Plans, and they vary from the type of plan and the provider.

For instance, if you had Original Medicare (Medicare Part A and B) + Medigap Plan G, the out-of-pocket expenses you need to make are your Part B premium, your Plan G premium, and the Part B deductible.

However, Medicare Supplement (Medigap) Plans don’t include prescription drug coverage, which is why it may be a good idea to also enroll in a standalone Part D prescription drug plan if you choose a Medigap policy.

Medicare Part D (Prescription Drug Coverage)

Medicare Part D helps cover your prescription drug costs, which both Original Medicare and Medicare Supplement (Medigap Plans) don’t cover.

Medicare Part D Plans are also provided by insurance companies. So they can set their own premiums, deductibles, and copays. You can enroll in a stand alone prescription drug plan, or you can enroll in a Medicare Advantage Plan with a built-in Part D prescription drug plan.

If you are already taking prescription medications, it’s very important to check your plan’s formulary to make sure your drugs are covered!

Medicare Part D also has extra costs for people in higher income brackets (IRMAA). Medicare prescription drug plans also have a late enrollment penalty if you don’t enroll when you’re supposed to and don’t have creditable drug coverage.

Should You Sign Up for Medicare Part B?

Most people do. Unless you have creditable coverage, signing up for Medicare Part B when you first become eligible will not only provide you with medical insurance, but you’ll also avoid Medicare Part B’s late enrollment penalty.

The older you get, the more susceptible you become to health conditions. Enrolling in Medicare can greatly reduce your out-of-pocket medical expenses as you get older.

Enrolling in Medicare Part B also allows you to get even more healthcare coverage by getting a Medicare Advantage Plan, or Medicare Supplement (Medigap) Plan + a Part D prescription drug plan.

However, there are a few situations where delaying Medicare Part B enrollment might be considered an option.

One is if you or your spouse are covered by your employer’s health plan, and that coverage is better than Medicare. If your employer has 20 or more employees, you can usually delay enrolling in Medicare Part B until you leave the company (or your employer’s plan coverage ends) without worrying about late enrollment penalties.

Some people also choose to stay on their employer’s health plan if it covers their wife and kids. When you enroll in Medicare Part B, it typically won’t cover your immediate family. That might be a reason to delay enrollment if you have credible coverage through your employer..

Conclusion: Ready to Enroll in Medicare Part B?

That’s the most important things you need to know about Medicare Part B!

It truly is one of the most important parts of Medicare and something that everyone turning 65 needs to fully grasp.

We hope this article helped simplify Medicare Part B for you.

If you still have questions, or need any help with Medicare at all, don’t hesitate to reach out!

You can call or text us and our team of licensed insurance agents to help find the right plan fit for you, avoid penalties, and get exactly what you’re looking for!